flow through entity canada

Tax purposes and accordingly its operations are reported on the members individual tax return. To help clarify this issue this document also includes a practical and detailed example of a publicly traded Canadian mining entity involved in issuing flow-through shares to investors.

The basic principle behind flow-through shares which are unique to the resource sector in Canada is that a mining corporation willing to forego the tax benefit of certain CEE and CDE amounts that it incurs can renounce.

. Again the earnings of the LLC are flowed through to the ultimate owners of the LLC for US tax purposes. A pass-through entity also called a flow-through entity is a type of business structure used to avoid double taxation. To avoid this a company may be registered as a pass-through entity so that the revenue earned is taxed as.

The flow-through share entered the Canadian tax code just over 25 years ago. Flow-through shares FTS can provide mining companies with reduced-cost access to financing in this situation. Accounting for flow-through shares with attached share purchase warrants.

A trust maintained primarily for the benefit of employees of a corporation or 2 or more corporations that do not deal at arms length with each other where one of the main purposes of the trust is to hold interests. An LLC is a type of entity that is offered in the US and for US tax purposes is a flow through entity. This rule applies for purposes of Chapter 3 withholding and for Form 1099 reporting and backup withholding.

Flow-through shares FTSs For technical information concerning the FTS program you may contact the following tax services offices. Flow-through entities are a common device used to limit taxation by. Trade or business of a flow-through entity is treated as paid to the entity.

Calgary 587-475-3766 Vancouver 604-666-8430 Rouyn-Noranda 438-357-1013. Understanding What a Flow-Through Entity Is. In Canada however investment corporations whether mortgage trust mutual fund or partnership are regarded as flow-through entities.

Flow-through limited partnerships are valuable to investors who have current income that will be taxed at the highest marginal rate. This triggers Internal. Looking back mining executives lawyers bankers and accountants believe this quirky Canadian tax innovation has generated billions for mining exploration and contributed to the development of some of the countrys most notable mines such as the Ekati and Diavik.

Income that is or is deemed to be effectively connected with the conduct of a US. Flow-through shares FTSs On July 10 2020 the Government of Canada announced changes to protect jobs and safe operations of junior mining exploration and other flow-through share issuers by extending the timelines for spending the capital they raise via flow-through shares by 12 months. A flow-through entity is a legal business entity that passes income on to the owners andor investors.

This means that the flow-through entity is responsible for the taxes and does not itself pay them. For more information concerning the processing of the forms you may contact the Business Returns DivisionCall 1-855-432-5517. You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following.

Flow-through shares have helped expand Canadas resource sector since their introduction to the Canadian tax system in 1954. Flow-through entities are used for several reasons including tax advantages. Flow-through LPs offer tax benefits to investors similar to flow-through shares but they have some different features.

Typically businesses are subject to corporate tax while business owners also have to pay a personal income tax. In the end the purpose of flow-through entities is the. Flow-through entities are considered to be pass-through entities.

A single member LLC is considered a disregarded entity for US. Corporate subsidiary Corporation form rather than flow-through form Most provinces and territories and federal corporations require initial registration as well as annual filings with Corporations Canada if a federal corporation and in the province or territory where the corporation is incorporated or registered. Flow-through LP units may be issued by an entity that purchases a diversified portfolio of flow-through shares.

The information in this section also applies if for the 1994 tax year you filed Form. All of the following are flow-through entities. For an interest in a flow-through entity use the Bonds debentures promissory notes and other similar properties area section 5 of the Schedule 3.

Person or entity new regulation 3017701-2 c 2 vi A classifies these entities as corporations. If you filed Form T664 for your shares of or interest in a flow-through entity and the proceeds of disposition were more than the fair market value the ACB of your investments may be affected. Where a single member LLC is owned by a non US.

At that time the Canadian government introduced provisions to allow for. Downsides to Flow-Through Entities There is a criticism on the flow-through entity this resulted from one of its drawbacks in which owners of entities are taxed on the income not directly receive by them but by. MM-TAX LLP United States Canada China International MM-TAX LLP United States Canada China International Choose the best type of entity.

A foreign partnership. This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain and loss resulting from the disposition of shares of or interests in a flow-through entity. This is definitely a factor that American businesses need to consider if they want to do business in Canada through an LLC.

On December 16 2020 the Department of Finance. Unlike flow-through shares where only the original investor can deduct renounced expenses the.

What Are Financial Statements Bdc Ca

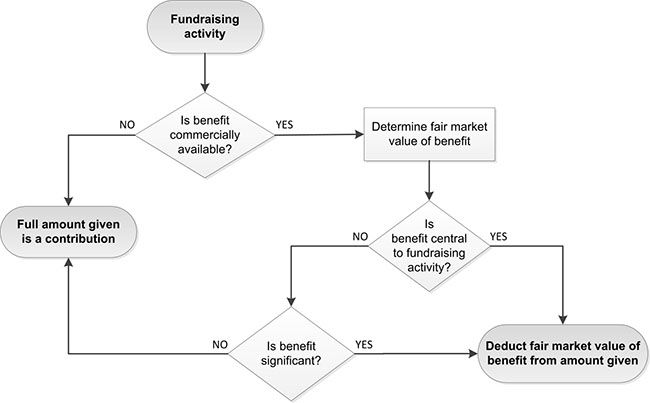

Political Financing Handbook For Registered Parties And Chief Agents Ec 20231 June 2021 Elections Canada

Accounting Decor Office Wall Decal Idea Teamwork Business Worker Inspire Office Decoration Motivatio

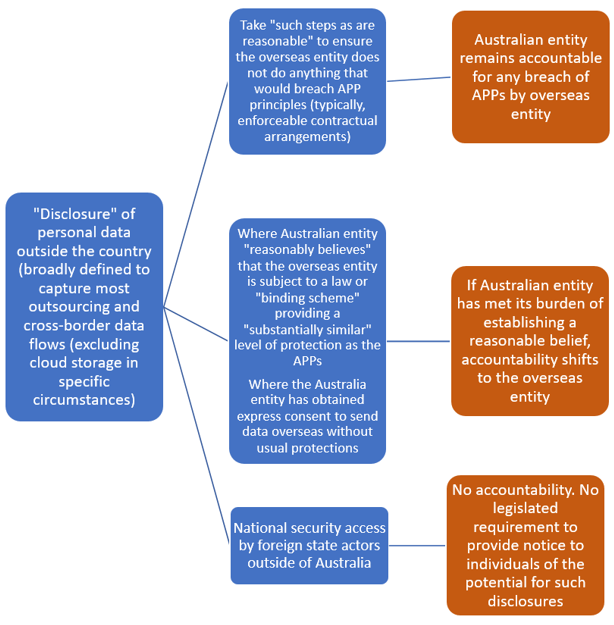

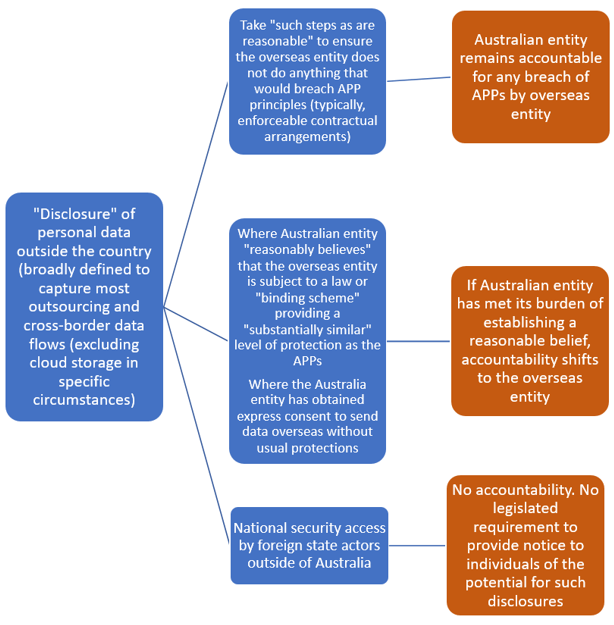

Appendix 3 Cross Border Data Flows And Transfers For Processing Jurisdictional Analysis Office Of The Privacy Commissioner Of Canada

Garden Of Displaced Roots The Open Workshop Archinect Landscape Architecture Drawing Architecture Presentation Architecture Journal

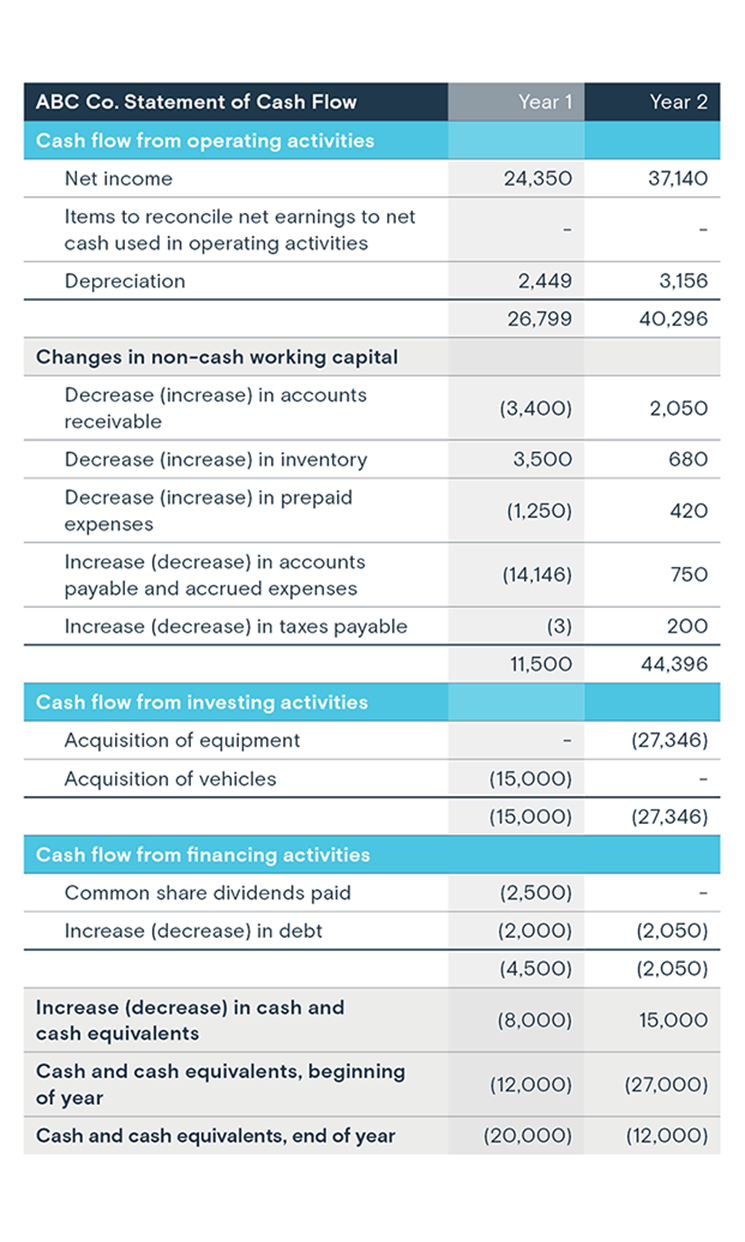

Negative Cash Flow Investments In Companies

Negative Cash Flow Investments In Companies

Pin By Business School On Fdi Infographic Japan Investing

What Is Input Tax Credit Or Itc Under Gst Exceldatapro Cash Flow Statement Accounting Tax Deductions

Statement Of Cash Flows How To Prepare Cash Flow Statements

26 Good Full Network Diagram Design Http Bookingritzcarlton Info 26 Good Full Network Diagram Design Diagram Design Diagram Design

Tree Specter Christmas Tree Topper Ghost Mini Led Tree Top Etsy Canada Christmas Tree Toppers Tree Toppers Christmas Ghost

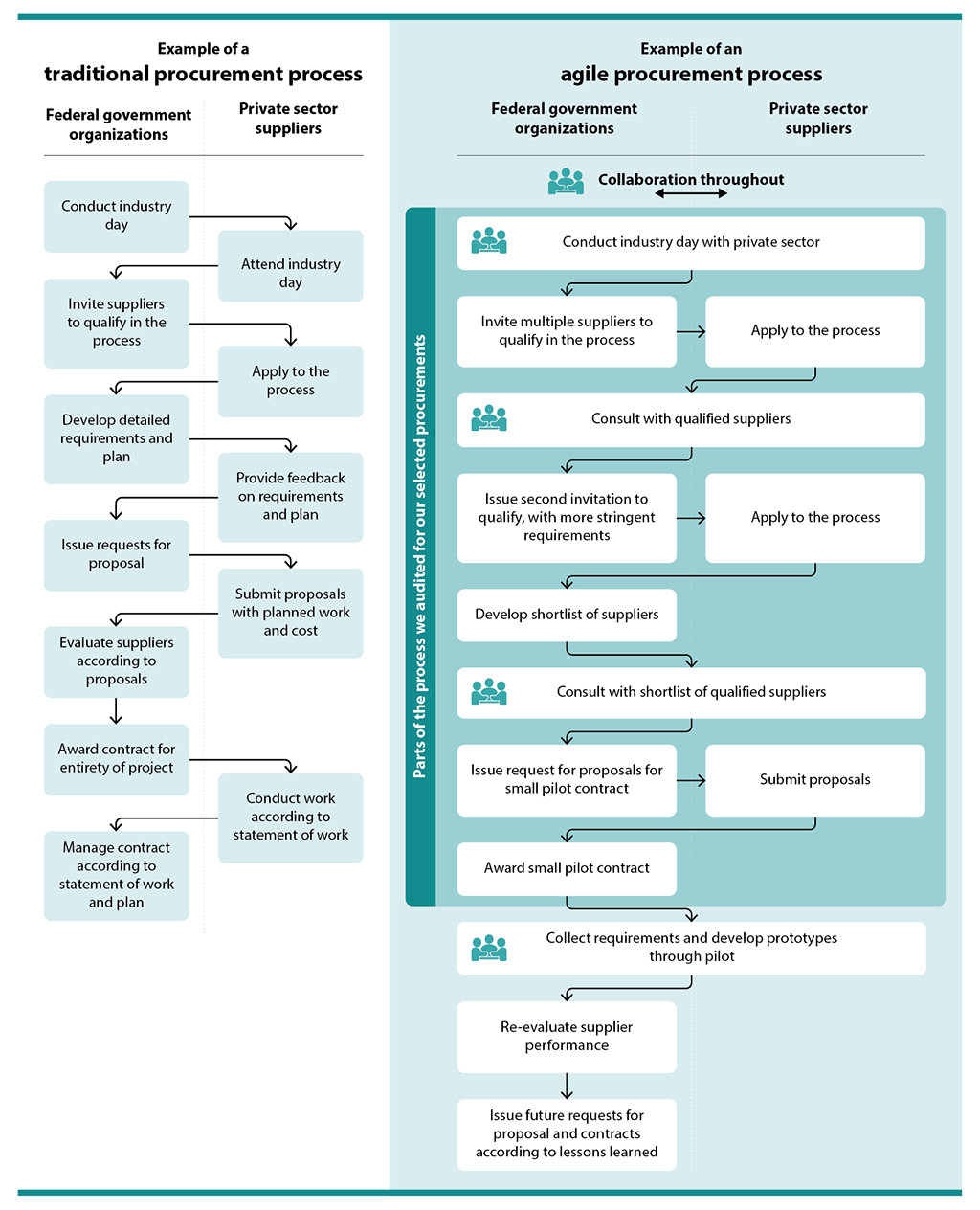

Report 1 Procuring Complex Information Technology Solutions

Are You Online Searching For The Professional Globevalve Manufacturer In Canada Cwt Valve Acts As A Premier Entity Catering In 2022 Forged Steel Manufacturing Valve

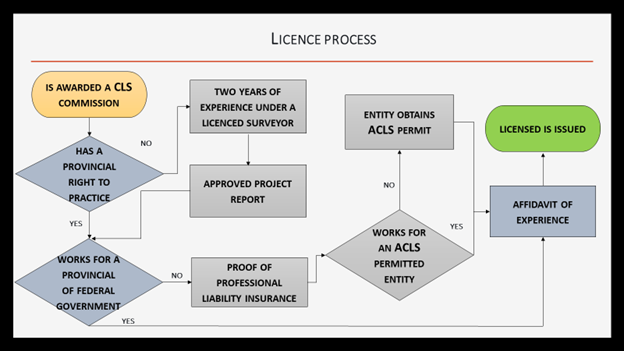

Acls Aatc Canada Path To Becoming A Cls

Neverness David Zindell Small Books Fiction Idea Science Fiction Novels

Limited Liability Partnership Llp Partnership Structure Kalfa Law

Pin Em Architecture Design Collection

Admin Boss Vs 3 Herobrine And Heeko All Episode Cool Minecraft Animation Youtube All Episodes Cool Minecraft Animation