nassau county sales tax rate 2020

Alaska has the lowest tax burden at about 51. Cook County collects on average 138 of a propertys assessed fair market value as property tax.

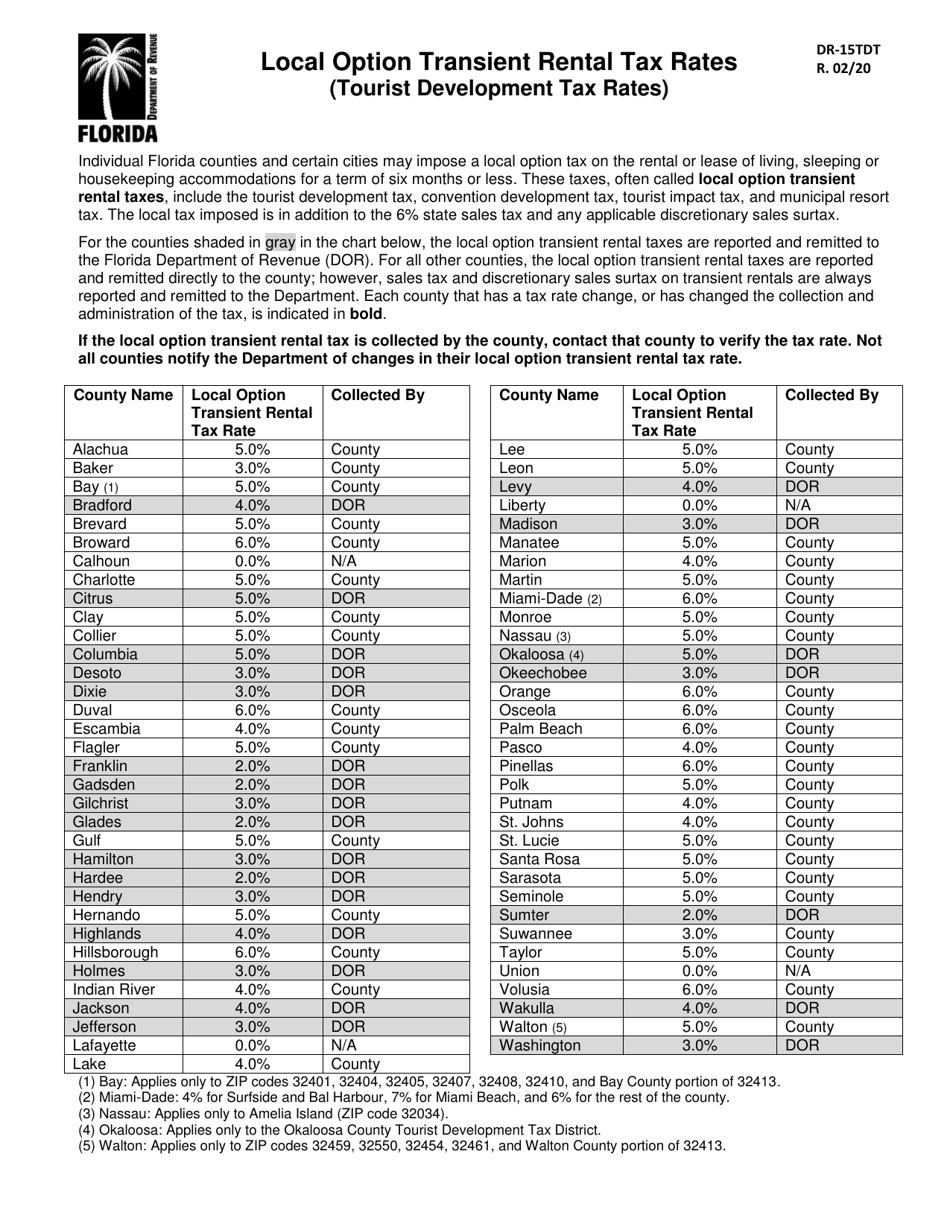

Form Dr 15tdt Download Printable Pdf Or Fill Online Local Option Transient Rental Tax Rates Tourist Development Tax Rates Florida Templateroller

Further the sale price must be greater than ten dollars and the number of days between the sale date and the contract date must be less than three hundred and sixty five or indeterminate.

. Nassau County Property Tax Search. Open Enrollment for Active Employees. Rate complaints and procedures.

Market values in Florida are evaluated as of January 1 based upon sales of comparable properties in the previous year. Equalization for coordinated assessment programs. Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes.

For instance she says the deadline for seniors applying for Oregons property tax deferral program was extended from April 15 to June 15 2020. The Nassau County Sales Tax is collected by the merchant on all qualifying sales made. The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800.

Sales selection criteria In order for a sale to be included in the above statistics it must be an arms length residential sale coded non-condominium. Rate Sheet for Retirees. Nassau County Office of Crime Victims Advocate - Brochures.

Building value. If you want to be very tax-conscious you should take into account all the types of taxes you may pay. 12 Ways to Get Your Retirement Plan Back on Track.

The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund transportation districts local attractions etc. Income taxes property taxes and sales taxes. Sales and use tax.

WalletHub rates New York state as having the highest total tax burden equal to about 128 percent of income followed by Hawaii at 122 percent. Total tax rate Property tax.

Florida Sales Tax Small Business Guide Truic

File Sales Tax By County Webp Wikimedia Commons

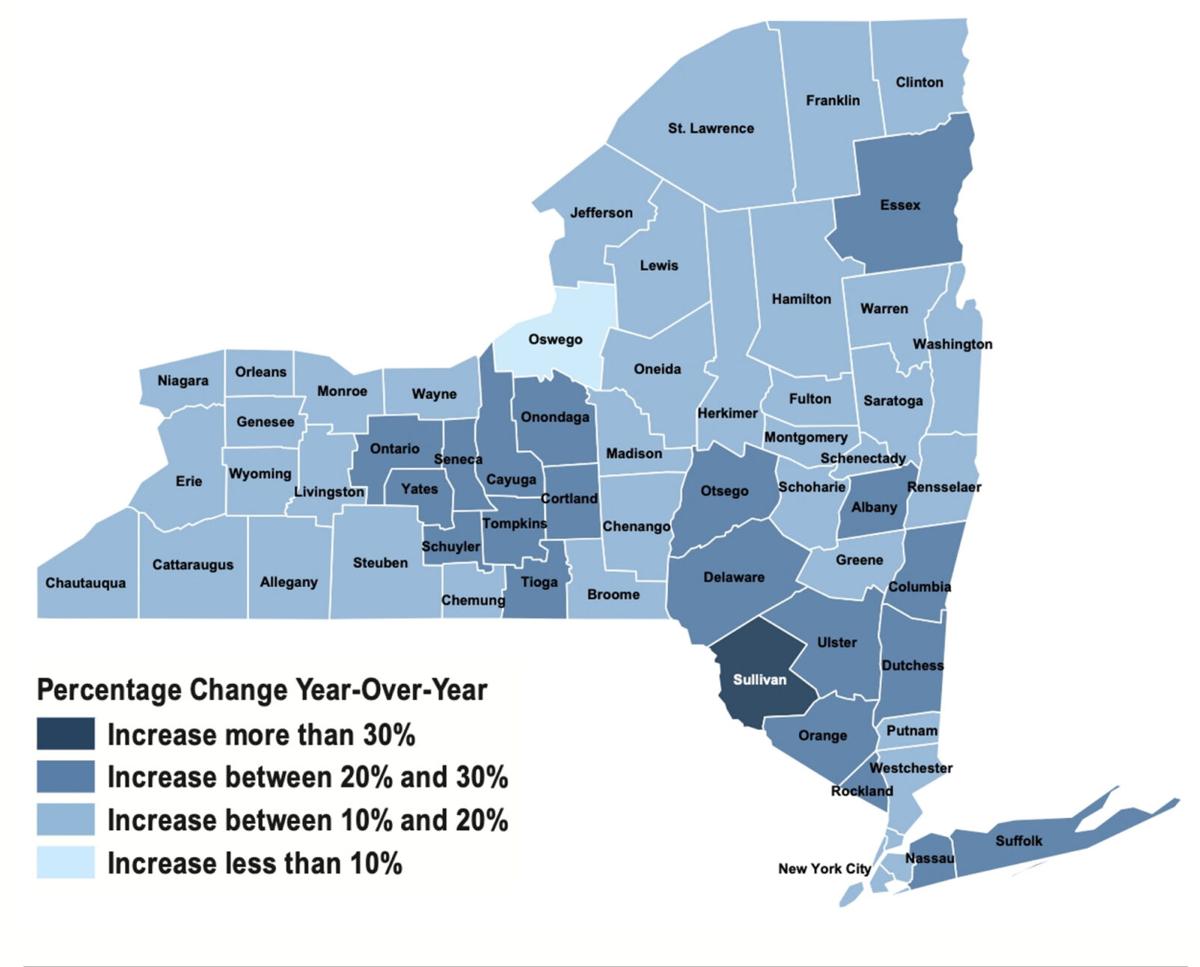

Comptroller Releases Troubling Projections Herald Community Newspapers Www Liherald Com

Real Estate Transfer Taxes In New York Smartasset

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Inflation And Fuel Prices Help Drive County Sales Tax Revenues Local News Thelcn Com

Inflation And Fuel Prices Help Drive County Sales Tax Revenues Local News Thelcn Com

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

New York Sales Tax Everything You Need To Know Smartasset

What Is New York S Sales Tax Discover The New York Sales Tax Rate In 62 Counties

How To Calculate Fl Sales Tax On Rent

Florida Sales Tax Rates By City County 2022

Make Sure That Nassau County S Data On Your Property Agrees With Reality

How To Calculate Sales Tax For Your Online Store

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit