cryptocurrency tax calculator canada

In this guide well break down Canadas cryptocurrency tax rules based on the latest guidance from the CRA and Revenu Quebec. Learn how to file your bitcoin in your taxes.

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency

Your total capital gain is the selling price minus the adjusted cost base of.

.jpg)

. The Canada Revenue Agency CRA treats cryptocurrency as a taxable commodity. Youll pay tax on your cryptocurrency profits in Canada. There are several steps and methods to calculating and using a cryptocurrency tax calculator or a crypto tax calculator.

Instead its viewed as a commodity which is a capital property - like a stock or a rental property. Gains and losses are calculated in your home fiat currency like the US Dollar to help you file your taxes with ease. Learn how to calculate and file your taxes if you live in Canada.

While 50 of capital gains. The Senate reviewed the issue of taxation on cryptocurrency in 2014 and recommended action to help Canadians understand how to comply with their taxes which the Canada Revenue Agency CRA is doing by presenting this. Find out what to do with your cryptocurrency when filing your income taxes with the Canadian Revenue Agency CRA.

Straightforward UI which you get your crypto taxes done in seconds at no cost. If the reasonable value fair market value of the gifts and awards you give your employee is more than 500 the amount over 500 will be taxable. Cryptocurrency is a relatively new innovation that requires guidelines on taxation so that Canadians are aware of how to meet their tax obligations.

Crypto Tax Calculator. Calculate and report your crypto tax for free now. Crypto taxes in Canada are confusing because there are so many use cases for crypto.

How is cryptocurrency taxed in Canada. Coinpanda generates ready-to-file forms based on your trading activity in less than 5. Whether you used an automated crypto trading app or made the trades yourself a crypto tax calculator will make it much easier to calculate how much you owe and fill out your.

Anyone who owns multiple exchange accounts or wallets knows the pains when it comes to declaring taxes. It is taxed either as business income or capital gains. Koinly is the only cryptocurrency tax calculator that is fully compliant with CRAs crypto guidance.

Cryptocurrency is taxed like any other commodity in Canada. Paying taxes on cryptocurrency in Canada doesnt have to be a headache. Canadian citizens have to report their capital gains from cryptocurrencies.

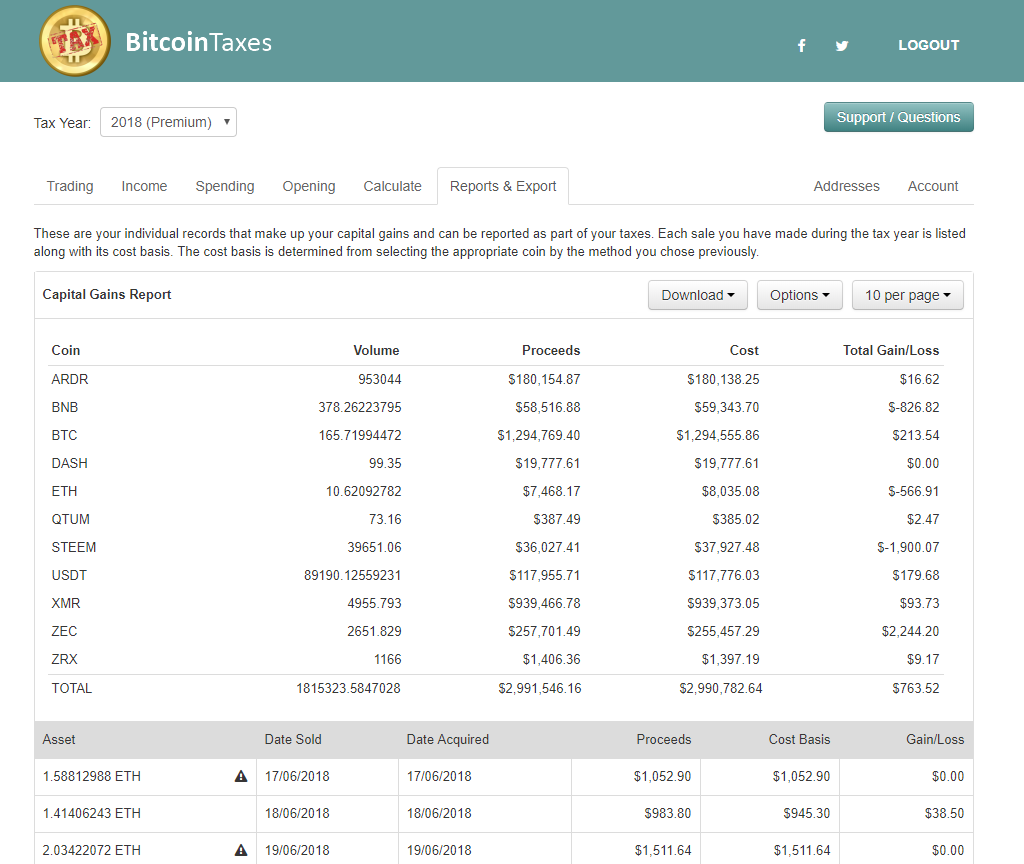

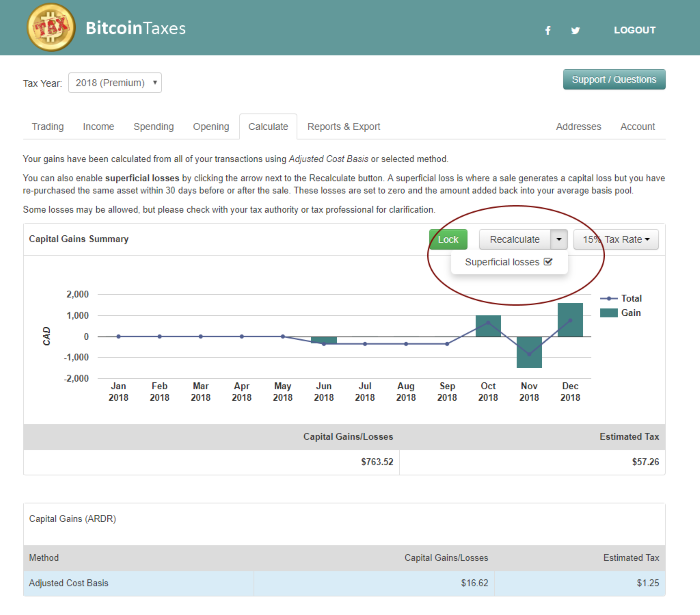

Capital gains tax report. At the time of writing Coinpanda is the only crypto tax solution today that can calculate cost basis correctly for Canada according to rules for Adjusted Cost Base and the Superficial Loss Rule. 5 March 2019.

Tax-Loss Harvesting With A Crypto Tax Calculator In general terms losses resulting from cryptocurrency trades are tallied against any gains made in the current year. Is cryptocurrency taxable in Canada. Lets say you bought a cryptocurrency for 1000 and sold it later for 3000.

Koinly is a cryptocurrency tax software for hobbyists investors and accountants. Cryptocurrency tax calculators work by retrieving data from your exchanges wallets and other cryptocurrency platforms. Cryptocurrency Tax Calculator.

Owners capital gain tax rate. Cryptocurrency isnt seen like a fiat currency in Canada. Generate ready-to-file tax forms including income reports for Forks Mining Staking.

Full integration with popular exchanges and wallets in Canada with more jurisdictions to come. February 12 2022 by haruinvest. Establishing whether or not your transactions are part of a business is very important.

It is 100 free to create an account and see if the software works for you. Koinly is compatible with Canadas tax laws and regulations and if you have a paid plan you can print tax reports including an income report capital gains report and a buysell report. 50 of the gains are taxable and added to your income for that year.

50 of your crypto gains are added to your income and taxed at your marginal tax rate youre only being taxed on your investment gains not the entire value of your crypto holdings. Note however that first short-term losses are applied against short-term gains and long-term losses are applied against long-term gains. They compute the profits losses and income from your investing activity based off this data.

Koinly was built to solve this very problem - by integrating with all major blockchains and exchanges such as Coinbase Binance Kraken etc Koinly reduces crypto tax reporting to a few. You would have to report a capital gain of 1000 50 of 2000 which would be added to your income and taxed at your. The CRA says Capital gains from the sale of cryptocurrency are generally included in income for the year but only half of the capital gain is subject to tax Simply put.

Taxes How to Claim Cryptocurrency on Your Income Tax in Canada. Report crypto on your taxes easily using Koinly a crypto tax calculator and software. Filing your taxes is already complicated but it can be more confusing if you have bought or sold cryptocurrency.

This article will cover how cryptocurrency is taxed in Canada how you can report your taxes and a few simple ways to reduce your tax liability. You can use crypto as an investment as a currency for spending or as a source of passive income. Tue May 19 2020 2 min read.

Welcome to your Canada cryptocurrency tax guide. For example if you receive cryptocurrency gifts with a total reasonable value of 650 there will be a tax implication on the excess 150 650-500. 25000 Original purchase price 20 fees 25020 Adjusted cost base Say the value of Bitcoin goes up and you sell your coin for 36000.

Koinly is a free-to-use crypto tax calculator that can help you file your crypto taxes in Canada. Capital gains and losses.

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

The Ultimate Canada Crypto Tax Guide 2022 Koinly

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Crypto Taxes In Canada Adjusted Cost Base Explained

The Ultimate Canada Crypto Tax Guide 2022 Koinly

.png)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

Cryptocurrency Taxes In Canada Cointracker

The Ultimate Canada Crypto Tax Guide 2022 Koinly

Cryptocurrency Taxes Canada 2022 Guide Finder Canada

Koinly Review 2022 A Crypto Tax Software For Canadians

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

Crypto Taxation In Canada 2022 Ultimate Guide Ocryptocanada

Canada Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax